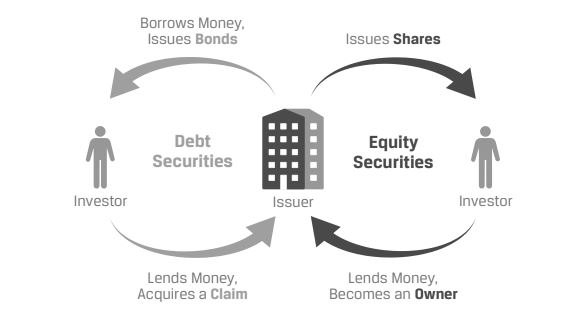

Below is a brief description of some the Asset Classes that are currently tradable in Boursa Kuwait, such as Equity Securities, and other classes that will be available for trading in the future, such as Bonds.

Equities

Equities In addition to borrowing funds, companies may raise external capital to finance their operations by issuing (selling) equity securities. Issuing shares (also called stock and shares of stock) is a company’s main way of raising equity capital.

Common stock (also known as common shares, ordinary shares, or voting shares) is the main type of equity security issued by companies. A common share represents an ownership interest in a company. Common shares have an infinite life; in other words, they are issued without maturity dates.

Common shares represent the largest proportion of equity securities by market value.

Shares of public companies typically trade on stock exchanges that facilitate trading of shares between buyers and sellers.

Common stock typically provides its owners with voting rights and cash flow rights in proportion to the size of their ownership stake. Companies often pay out a portion of their profits each year to their shareholders as dividends which are typically declared by the board of directors. As owners of the underlying company, common shareholders participate in the performance of the company and have a residual claim on the company’s liquidated assets after all liabilities (debts) and other claims with higher seniority have been paid.

Bonds

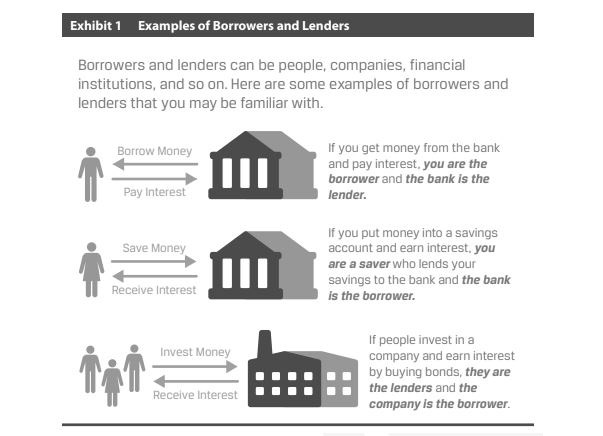

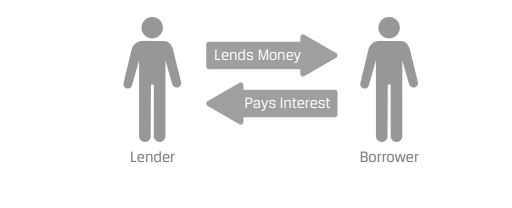

When a large company or government borrows money, it usually does so through financial markets. The company or government issues securities that are generically called debt securities, or bonds. Debt securities represent a contractual obligation of the issuer to the holder of the debt security. Companies and governments may have more than one issue of debt securities (bonds). Each of these bond issues has different features attached to it, which affect the bond’s expected return, risk, and value.

A bond is governed by a legal contract between the bond issuer and the bondholders. In the event that the issuer does not meet the contractual obligations and make the promised payments, the bondholders typically have legal recourse. The legal contract describes the key features of the bond.

A typical bond includes the following three features which define the promised cash flows of the bond and the timing of these flows:

1)

Par value (also called principal value or face value): the amount that will be paid by the issuer to the bondholders at maturity to retire the bonds

2)

Coupon rate: the promised interest rate on the bond

3)

Maturity date: The life of the bond ends on its maturity date, assuming that all promised payments have been made.

The bond contract gives bondholders the right to take legal action if the issuer fails to make the promised payments or fails to satisfy other terms specified in the contract. If the bond issuer fails to make the promised payments, which is referred to as default, the debtholders typically have legal recourse to recover the promised payments. In the event that the company is liquidated, assets are distributed following a priority of claims, or seniority ranking. This priority of claims can affect the amount that an investor receives upon liquidation.

Because debt represents a contractual liability of the company, debtholders have a higher claim on a company’s assets than equity holders. But not all debtholders have the same priority of claim: borrowers often issue debt securities that differ with respect to seniority ranking. In general, bonds may be issued in the form of secured or unsecured debt securities.

.jpg)

© 2018, CFA Institute. All rights reserved

.jpg)