|

Basics of Investment Evaluation

Understanding Financial Reports

The company’s financial performance matters to investors because it affects the returns on their investments.

One way to begin to evaluate a company is to look at its past performance. The primary summary of past performance is a company’s financial statements, which indicate, among other things, how successful a company has been at generating a profit to repay or reward investors.

Companies obtain funds from investors from either the sale of debt securities (bonds) or the sale of equity securities (shares of stock, sometimes referred to as stocks or shares). The value of the debt and equity securities to investors depends on a company’s future success along with its ability to repay its debt and to create returns for shareholders to compensate for the risks they assume.

Financial statements are historical and forward looking at the same time; they focus on past performance but also provide clues about a company’s future performance. This information is communicated through:

The balance sheet (also called statement of financial position or statement of financial condition): shows what the company owns (assets) and how it is financed. The financing includes what it owes others (liabilities) and shareholders’ investment (equity).

The income statement (also called statement of profit or loss, profit and loss statement, or statement of operations) identifies the profit or loss generated by the company during the period covered by the financial statements.

The cash flow statement shows the cash received and spent during the period.

Notes to the financial statements provide information relevant to understanding

and assessing the financial statements.

These financial statements show the monetary value of the economic resources under the company’s control and how those resources have been used to create value.

The Balance Sheet (also called statement of financial position or statement of financial condition)

The fundamental relationship underlying the balance sheet, known as the accounting equation, is:

Total assets = Total liabilities + Total shareholders’ equity

The balance sheet provides information about the company’s financial position at a specific point in time, such as the end of the fiscal year or the end of the quarter.

Essentially, it shows:

• the resources the company controls (assets),

• its obligations to lenders and other creditors (liabilities or debt), and

• owner-supplied capital (shareholders’ equity, stockholders’ equity, or owners’ equity).

Balance sheets typically classify assets as current and non-current. The difference between them is the length of time over which they are expected to be converted into cash, used up, or sold.

Current assets, which include cash; inventories (unsold units of production on hand called stocks in some parts of the world); and accounts receivable (money owed to the company by customers who purchase on credit, sometimes called debtors), are assets that are expected to be converted into cash, used up, or sold within the current operating period (usually one year).

A company’s operating period is the average amount of time elapsed between acquiring inventory and collecting the cash from sales to customers.

Non-current assets (sometimes called fixed or long-term assets) are longer term in nature. Non-current assets include tangible assets, such as land, buildings, machinery, and equipment, and intangible assets, such as patents. These assets are used over a number of years to generate income for the company.

The tangible assets are often grouped together on the balance sheet as property, plant, and equipment (PP&E). Non-current assets may also include financial assets, such as shares or bonds issued by another company. When a company purchases a long-term (non-current) asset, it does not immediately report that purchase as an expense on the income statement. Instead, the purchase amount is capitalised and reported as an asset on the balance sheet.

For a capitalised, long-term asset, the company allocates the cost of that asset over the asset’s estimated useful life. This process is called depreciation. The amount allocated each year is called the depreciation expense and is reported on the income statement as an expense. The purchase amount represents the gross value of the asset and remains the same throughout the asset’s life. The net book value of the long-term asset, however, decreases each year by the amount of the depreciation expense.

Net book value is calculated as the gross value of the asset minus accumulated depreciation, where accumulated depreciation is the sum of the reported depreciation expenses for the particular asset. Details about the original costs, depreciation expenses, and accumulated depreciation of property, plant, and equipment can be found in the notes to the financial statements.

Other assets that might be included on a company’s balance sheet are long-term financial investments, intangible assets (such as patents), and goodwill. Goodwill is recognised and reported if a company purchased another company, but paid more than the fair value of the net assets (assets minus liabilities) of the company it purchased.

The additional value reflected in goodwill is created by other items not listed on the balance sheet, such as a loyal customer base or skilled employees. The process of expensing the costs of intangible assets over their useful lives is called amortisation; this process is similar to depreciation.

The other balance sheet items—liabilities and equity—represent how the company’s assets are financed. There are two fundamental types of financing: debt and equity. Debt is money that has been borrowed and must be repaid at some future date; therefore, debt is a liability—an obligation for which the company is liable. Equity represents the shareholders’ (owners’) investment in the company.

Debt can be split into current (short-term) liabilities and long-term debt. Current liabilities must be repaid in the next year and include operating debt, such as accounts payable (credit extended by suppliers, sometimes called creditors), short-term borrowing (for example, loans from banks), and the portion of long-term debt that is due within the reporting period. Unpaid operating expenses, such as money due to workers but not yet paid, are often shown together as accrued liabilities.

Long-term debt is money borrowed from banks or other lenders that is to be repaid over periods greater than one year.

Shareholders are the residual owners of the company; that is, they own the residual value of the company after its liabilities are paid. The amount of the company’s equity is shown on the balance sheet in two parts: (1) the amount received from selling stock to common shareholders, which are direct contributions by owners when they purchase shares of stock; and (2) retained earnings (retained income), which represents the company’s undistributed income (as opposed to the dividends that represent distributed income).

Retained earnings are an indirect contribution by owners who allow the company to retain profits. Retained earnings represent a link between the company’s income statement and the balance sheet. When a company earns profit and does not distribute it to shareholders as a dividend, the remaining profit adds value to the company’s equity. Likewise, if the company experiences a net loss, that decreases the value of its retained earnings and thus its equity; the company becomes less valuable because it has lost, rather than earned, value.

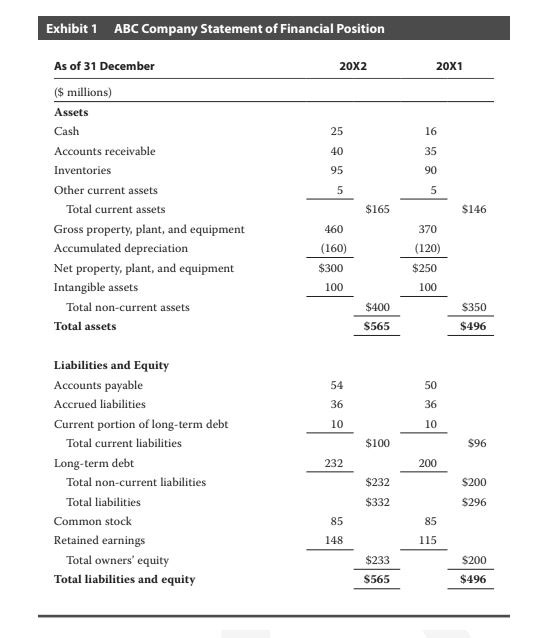

INSERT EXHIBIT 1: ABC COMPANY STATEMENT OF FINANCIAL POSITION>>>>

The Income Statement (sometimes called statement of profit or loss, profit and loss statement, or statement of operations)

The income statement identifies the profit or loss generated by a company during a given time period, such as a year. Generating profit over time is essential for a company to continue in business. In practice, the income statement may be referred to as the “P&L”.

The income statement shows the company’s financial performance during a given time period. It includes the revenues earned from the company’s operation and the expenses of earning those revenues. The difference between the revenues and the expenses is the company’s profit. In its most basic form, the income statement can be represented by the following equation:

Profit (Loss) = Revenues – Expenses

Expenses are the cost of company resources—cash, inventories, equipment, and so on—that are used to earn revenues. Expenses can be divided into different categories that reflect the role they play in earning revenues. Typical categories include:

• Operating expenses, which include the cost of sales (or cost of goods sold); selling, general, and administrative expenses; and depreciation expenses

• Financing costs, such as interest expenses

• Income taxes

Different measures of profit can be calculated by subtracting different categories of expenses from revenues. These measures are sometimes reported on the income statement. For example, subtracting the cost of sales, which represents the cost of producing or acquiring the products or services that are sold by a company, from revenues gives gross profit.

Gross Profit = Revenues – Cost of Sales

There are other operating expenses, such as marketing expenses, administrative expenses, and depreciation expenses. Subtracting these additional costs from gross profit gives operating income, or operating profit.

Operating Income = Gross Profit – Other Operating Expenses

Operating income is often referred to as earnings before interest and taxes (EBIT). Operating income is the income (earnings) generated by the company before taking into account financing costs (interest) and taxes.

Another important measure of income is earnings before interest, taxes, depreciation, and amortisation (EBITDA). EBITDA is operating income before depreciation and amortisation expenses are deducted. The amounts of depreciation and amortisation are not cash flows, and they are determined by the choice of accounting method rather than by operating decisions.

EBITDA is useful because it offers a closer approximation of operating cash flow than EBIT. It is an indicator of the company’s operating performance and its management’s ability to generate revenues and control expenses that are related to its operations. EBITDA may be a better measure than EBIT of management’s ability to manage the revenues and expenses within its control. This measure does not appear, as such, on a company’s income statement.

EBITDA = EBIT (or Operating Income) + Depreciation and Amortisation

Net income represents the income that the company has available to retain and reinvest in the company (retained earnings) or to distribute to owners in the form of dividends (disbursements of profit).

Net Income = EBIT (or operating income) – Interest Expense – Tax Expense

The company’s owners (shareholders) are interested in knowing how much income the company has created per share, which is called earnings per share (EPS). It is approximated as net income divided by the number of shares outstanding. Existing and potential investors are also interested in the amount of dividends the company pays for each share outstanding, or dividend per share.

The income statement shows a company’s profit, but profit is not the same as net cash flow—that is, how much cash the company generated during the period. A company acquiring or producing a unique item for a customer may require payment before the sales transaction is completed and the revenue earned. In this case, there is cash without revenue. Likewise, an expense can be incurred and accounted for without being paid if a supplier extends credit, or an expense can be paid for before it is actually incurred (prepaid).

On the income statement, profits are measured on an accrual basis, which means that revenues are recorded when the revenues are earned rather than when they are received in cash and that related expenses may be recognised before or after they are paid out in cash.

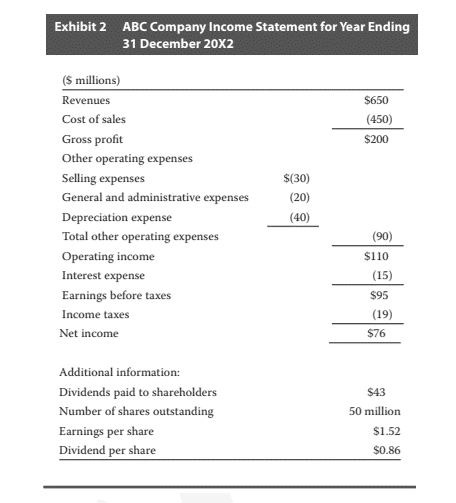

INSERT EXHIBIT 2: ABC COMPANY INCOME STATEMENT>>>>>>>>>>>>

The Cash Flow Statement

The statement of cash flows (or cash flow statement) identifies the sources and uses of cash during a period and explains the change in the company’s cash balance reported on the balance sheet.

The classification of cash flows as operating, investing, or financing is critical to show investors and others not only how much cash was generated, but also how cash was generated. Operating activities are usually recurring activities: they relate to the company’s profit-making activities and occur on an ongoing basis.

In contrast, investing and financing activities may not recur; the purchase of equipment or issuance of debt, for example, does not occur every year. So, knowing how the company generates cash—by recurring or non-recurring events—is important for estimating a company’s future cash flows.

The cash inflows and outflows of a company are classified and reported as one of three kinds of activities.

1) Cash flows from operating activities: reflect the cash generated from a company’s operations, its main profit-creating activity. Cash flows from operating activities typically include cash inflows received for sales and cash outflows paid for operating expenses, such as cost of sales, wages, operating overheads, and so on.

2) Cash flows from investing activities: are typically cash outflows related to purchases of long-term assets, such as equipment or buildings, as the company invests in its long-term resources. Sales of long-term assets are reported as cash inflows from investing activities.

3) Cash flows from financing activities: are cash inflows resulting from raising new capital (an increase in borrowing and/or issuance of shares) and cash outflows for payment of dividends, repayment of debt, or repurchase of shares (also known as share buybacks)

Each net cash flow from operating, investing, and financing activities will be positive or negative depending on whether more cash came in (positive) or went out (negative). The net cash flows from operating activities, investing activities, and financing activities are added together to arrive at the net cash flow during the accounting period.

The net cash flow corresponds to the change in the amount of cash reported on the balance sheet.

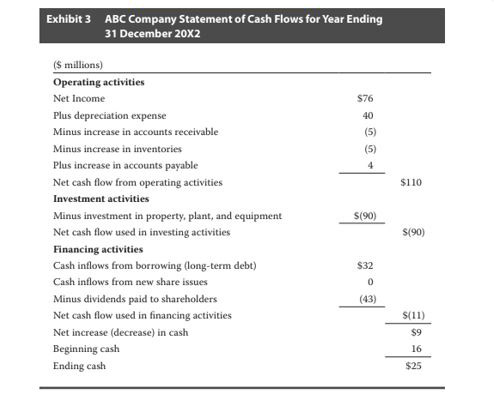

INSERT EXHIBIT 3: ABC COMPANY STATEMENT OF CASH FLOWS>>>>>>>>>>>>

|