|

How to Trade

Investors buy and trade securities that are issued by companies and governments that need to raise capital. Markets in which companies and governments sell their securities to investors are known as primary markets. Each type of security has its own primary market. For example, in most countries, there is a primary market for shares issued by companies or bonds issued by the sovereign (national) government.

Investors also trade securities, such as shares and bonds, as well as contracts, such as futures and options. These trades take place in secondary markets. When trading securities and contracts in secondary markets, investors often obtain assistance from trading services providers, such as brokers and dealers.

Brokers, dealers, clearing houses, settlement agents, custodians, and depositories provide various services that facilitate investment by helping buyers and sellers of securities and investment assets arrange trades with each other and by holding assets for clients.

Brokerage services are provided to clients who want to buy and sell securities; they include not only execution services (that is, processing orders on behalf of clients) but also investment advice and research. Brokerage services are provided by brokerage firms or brokers.

Brokers are agents who arrange trades for their clients. They do not trade with their clients. Instead, they search for traders who are willing to take the other side of their clients’ orders. Brokers help their clients by reducing the cost of finding counterparties for their clients’ trades. Brokers provide many different trading services.

Clients pay commissions to their brokers for arranging their trades. The commissions vary widely but typically depend on the value or quantity traded. It is worth noting that commissions have decreased over the past 30 years, primarily because of deregulation, technological progress, and increased competition among brokers.

Brokers often also ensure that their clients settle their trades. Such assurances are essential when exchanges arrange trades between strangers who do not have credit arrangements with each other. For such trades, brokers guarantee the settlement of their clients’ trades.

Dealers make it possible for their clients to trade without having to wait to find a counterparty; they are ready to buy from clients who want to sell and to sell to clients who want to buy. Dealers thus participate in their clients’ trades, in contrast to brokers who do not trade with their clients but only arrange trades on behalf of their clients. Dealers profit when they can buy securities for less than they sell them—that is, when the price at which they buy securities (called the bid price) is lower than the price at which they sell them (called the ask price or offer price).

If dealers can arrange trades simultaneously with buyers and sellers, they will make risk-free profits. Dealers risk losses if prices fall after they purchase but before they can sell or if prices rise after they sell but before they can repurchase.

Dealers provide liquidity to their clients by allowing them to buy and sell when they want to trade. In effect, dealers match buyers and sellers who want to trade the same instrument at different times and are thus unable to trade directly with each other. In contrast, brokers must bring a buyer and a seller together to trade at the same time and place. Dealers are often called market makers because they are willing to make a market (that is, trade on demand) in specified securities at their bid and ask prices.

Making a Trade

When investors want to trade a security, they issue an order that will be directed to a chosen trading venue. All orders specify what security to trade, whether to buy or sell, and how much should be bought or sold.

Order Execution Instructions

Order execution instructions indicate how to fill an order. Boursa Kuwait’s order types are limit and market orders which are the most common execution instructions.

A limit order instructs the broker or trading venue to obtain the best price immediately available when filling the order, but it also specifies a limit price, that is, a ceiling price for a buy order and floor price for a sell order. A trade cannot be arranged at a price higher than the specified limit price when buying or a price lower than the specified limit price when selling.

A market order instructs the broker or trading venue to obtain the best price immediately available when filling the order. Market orders generally execute immediately if other traders are willing to take the other side of the trade.

The main drawback with market orders is that a market buy order may fill at a high price and a market sell order may fill at a low price. The filling of orders at disadvantageous prices is particularly likely when the order is placed in a market for a thinly traded security or when the order is large relative to normal trading activity in the market.

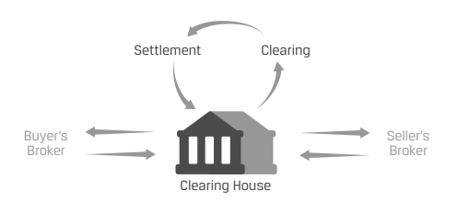

Clearing

The most important clearing activity is confirmation, which is performed by clearing houses. Before a trade can be settled, the buyer and seller must confirm that they traded and the exact terms of their trade. Confirmation generally takes place on the day of the trade and is necessary only for manually arranged trades. For electronic trades, confirmation is done automatically.

Settlement

Following confirmation, settlement takes three trading days (also known as T+3) on Boursa Kuwait. The seller must deliver the security to the clearing house and the buyer must deliver cash. The settlement agent then makes the exchange in a process called delivery versus payment. This process eliminates the losses that would occur if one party settles and the other does not.

Once a trade is settled, the settlement agent reports the trade to the issuing company’s transfer agent, which maintains a registry of who owns the company’s securities. Most transfer agents are banks or trust companies, but sometimes companies keep their own records and act as their own transfer agents. Companies need to maintain databases about their security holders so they know who is entitled to any interest and dividend payments, who can vote in corporate elections, and to whom various corporate communications should be sent.

Trading Costs

The costs associated with trading are called transaction costs and include two components: explicit costs and implicit costs.

Explicit Trading Costs

Explicit trading costs represent the direct costs associated with trading. Brokerage commissions are the largest explicit trading cost. Most market participants employ brokers to trade on their behalf. They pay their brokers commission for arranging their trades. The commissions are usually a fixed percentage of the principal value of the transaction or a fixed price per share, bond, or contract.

The commissions compensate brokers for the resources they use to fill orders. Brokers must maintain order routing systems, market data systems, accounting systems, exchange memberships, office space, and personnel to manage the trading process. These are all fixed costs. Brokers also pay variable costs, such as exchange, regulatory, and clearing fees, on behalf of their clients.

Implicit Trading Costs

Implicit trading costs are the indirect costs associated with trading. These costs result from the following:

1) Bid–Ask Spread: Many investors assess a market’s liquidity by looking at the difference between bid and ask prices, called bid–ask spreads. Recall that bid prices are the prices at which dealers are willing to buy and ask prices are the prices at which dealers are willing to sell.

2) Price Impact: Traders who want to trade quickly tend to purchase at higher prices than the prices at which they sell. The difference comes from the price concessions that they offer to encourage other traders to trade with them. For large trades, impatient buyers generally must raise prices to encourage other traders to sell to them. Likewise, impatient sellers of large trades must lower prices to encourage other traders to purchase from them. These price concessions, called price impact, or market impact, often occur as large-trade buyers push prices up and large-trade sellers push them down.

3) Opportunity Costs: Traders who are willing to wait until other traders want to trade with them generally incur lower transaction costs on their trades. In particular, by using limit orders instead of market orders, they can buy at the bid price or sell at the ask price. But these traders risk that they will not trade when the market is moving away from their orders. They lose the opportunity to profit if their buy orders fail to execute when prices are rising, and they lose the opportunity to avoid losses if their sell orders fail to execute when prices are falling. The costs of not trading are called opportunity costs.

|